Owning Makes More Sense

When comparing the cost of owning a home to renting, there is more than the difference in house payment against the rent currently being paid. It very well could be lower than the rent but when you consider the other benefits, owning could be much lower than renting.

|

Each mortgage payment has an amount that is used to pay down the principal which is building equity for the owner. Similarly, the home appreciates over time which also benefits the owner by increasing their equity.

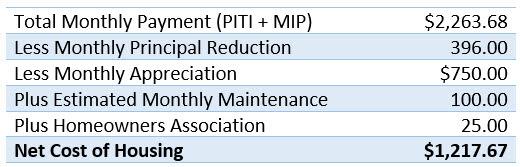

There are additional expenses for owning a home that renters don't have like repairs and possibly, a homeowner's association. To get a clear picture, look at the following example of a $300,000 home with a 3.5% down payment on a 4.5%, 30-year mortgage.

The total payment is $2,264 including principal, interest, property taxes, property and mortgage insurance. However, when you consider the monthly principal reduction, appreciation, maintenance and HOA, the net cost of housing is $1,218. It costs $1,282 more to rent at $2,500 a month than to own. In a year's time, it would cost $15,000 more to rent than to own which is more than the down payment and closing costs to buy the home.

Comments

Post a Comment